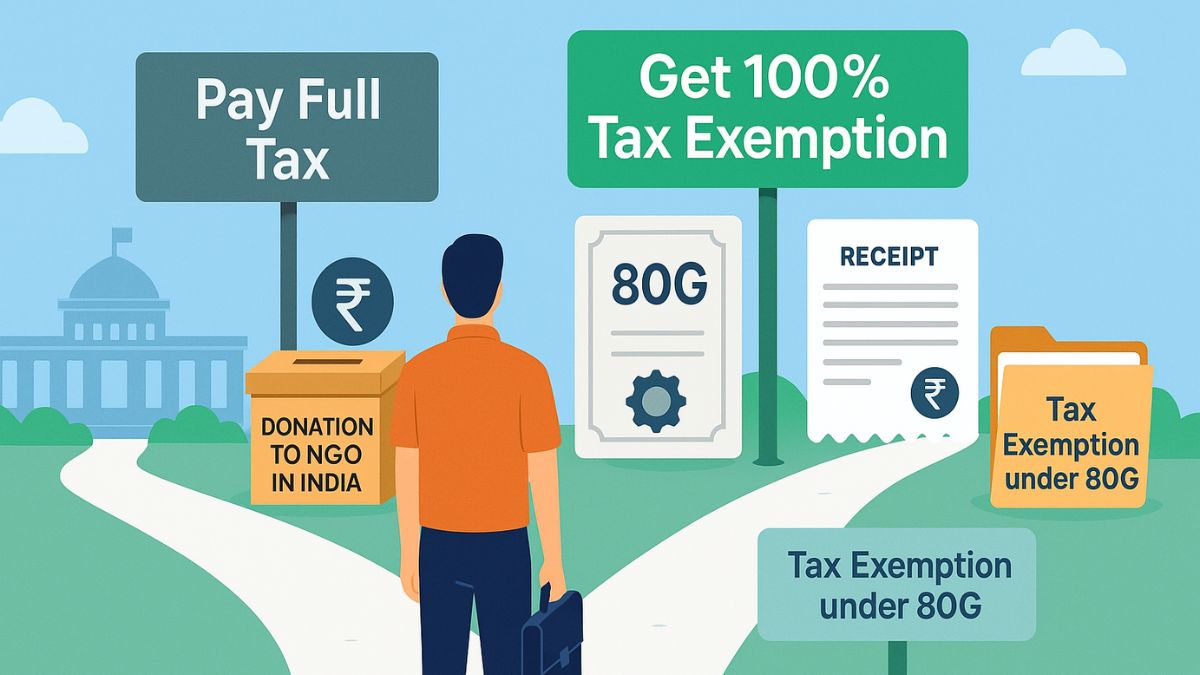

Giving tax is a duty, but did you know that you could save tax while doing social good? The government of India promotes philanthropy by providing tax benefits to individuals and businesses who donate to approved institutions. Donating to relief funds and government-approved trusts is one of the easiest ways to get a 100% tax exemption.

What Does 100% Tax Exemption Mean?

When you give to qualifying institutions, a portion—or, in certain instances, the entire value—of your donated amount may be claimed as a deduction from your tax payable. A 100% tax exemption implies that the entire value of your entire donated amount is not included in your taxable income and this will lower your tax bill without any loss on your part.

For instance, if your income is ₹10,00,000 annually and you give ₹50,000 to a recognized fund that grants 100% exemption, your tax payable becomes ₹9,50,000. This reduces the tax you have to pay.

Where Can You Donate to Get 100% Exemption?

Not all donations are eligible for full exemption. The government has a list of certain institutions and funds that are recognized. Some of them include:

- Prime Minister's National Relief Fund (PMNRF)

- National Defence Fund

- Swachh Bharat Kosh

- Clean Ganga Fund

- Chief Minister's Relief Funds (a few states)

Donations are generally intended for the nation's welfare, relief in case of calamities, or big public health and infrastructure projects.

Documents You Need

For tax exemption on Donation, you should keep proper documentation. Always take a stamped receipt from the organization that contains:

- Donor's name

- Amount donated

- Date of donation

- PAN of the receiving organization

- Registration number and validity under the Income Tax Act

- Without such information, your exemption claim could be denied or restricted.

How to Claim the Exemption?

While filing your income tax return, you will have a place where you can fill in details of your donation. Insert the qualifying amount, include scanned copies of your receipts (if requested), and include the institution's registration information. Your tax software or tax advisor will prompt you on how to calculate it.

It should be remembered that cash donations over ₹2,000 are not tax-exempt. Alway give via cheque, bank transfer, UPI, or other traceable means.

Read to know More About: How to Maximize Your Tax Savings by Donating to an NGO

Know the Difference: 50% vs 100% Exemption

Whereas a few donations grant a complete exemption, most grant only 50% relief from tax. The rate is determined by the organization's type and certification status. You can get this information on the government website of the NGO or on official lists published by the government.

If donating to a registered NGO in India, cross-check whether they are included for full or partial exemption under the concerned section.

Most importantly, to benefit from all this, make sure your donation is eligible under tax exemption under 80G of the Income Tax Act.

By donating intelligently, you're not only lowering your taxes—you're also contributing to social causes that really count. This is how tax exemption on donation becomes a win-win for you and society.